Clients aren’t the only ones who need a retirement strategy. You’ve spent what seems like a lifetime building a successful business. Have you made time to think about your succession plan though? It’s never too early to consider what your transition into retirement will look like, and how you will make sure your clients will be well taken care of, too.

For over a decade, Marshall Financial Transitions has helped advisors ease into retirement using our streamlined process. Our customized succession strategy provides a smooth transition for both you and your clients that’s based on mutual respect. We work with you to determine a fair value and payment structure for your practice based on industry standards and your succession timeline.

Our typical retention rate for clients who come to us through a merger or buyout is over 95%. As an independent wealth management firm and Registered Investment Advisor (RIA), Marshall Financial Group is dedicated to growing and protecting clients’ financial assets throughout every phase of life. We do it all within a culture that is client-centered, where we constantly strive to exceed expectations.

WE CAN HELP YOU START PLANNING FOR YOUR RETIREMENT.

Contact us today!

Our commitment to exceptional client service begins during your transition, when our team of advisors and administrators create a smooth and seamless path for clients as they become valued members of the Marshall Financial Group family. Clients appreciate our use of the latest reporting and trading software, our model portfolios, and a structured marketing schedule that includes many client retention initiatives. Most importantly, we believe every client interaction should be grounded in transparency, kindness, and integrity – all part of our commitment to building trust from day one. When the time comes, you can retire in confidence knowing your clients are in good hands.

FLEXIBLE PARTNERSHIP OPPORTUNITIES

Our goal is to be accommodating and respectful of your preferred next step. You might be an experienced advisor looking to join an established firm that has similar values. Or perhaps you are looking to merge and retire soon. Rest assured, your goals and timeline can be accommodated.

SUCCESSION PLANNING

If you are ready to retire, we can work with you to create a timeline that will ensure the seamless transition into Marshall Financial Group. We will treat your clients with respect and care during the transition thanks to our dedicated team.

Succession PlanningContact us to directly about our succession planning opportunities.

Schedule a CallPARTNERSHIP

We welcome experienced advisors that want to take their practice to the next level by joining our established RIA firm. If both parties agree that we are a ‘right fit’, we will work together to design a partnership that is mutually beneficial.

Merger PartnershipContact us to learn more about our partnership opportunities.

Schedule a CallWe know how to transition practices and have developed a streamlined system we can adapt to meet your circumstances. If you want to retire soon, we can act swiftly to help you make an announcement and notify clients that their account(s) will be moving to Marshall Financial Group. During this period, we connect with each new client to make certain they understand the process and are comfortable with the transition. If you have more time before you plan to retire and are interested in a gradual approach, we can develop a phased-in strategy announcing that you’ve joined or merged with our team.

During the initial client introduction, you and a Marshall Financial Group advisor will explain how the transition will work and all of the benefits they will experience at our firm. We take the time to walk through our approach to financial planning, reporting, and the many other services we provide. Where our services and tactics overlap with yours, we will promote continuity. We will also share information about any new technologies and services your clients will enjoy as a result of working with us.

Marshall Financial Group’s dedicated client service team has developed a well-defined onboarding process that includes preparing and tracking all the necessary paperwork, monitoring account transitions, and sending new client welcome letters. Once the client has been officially welcomed to our firm, they receive a performance report during the initial quarterly fee bill cycle, after which we will begin scheduling them for regular reviews with their new advisor. Within the first year, the client will receive a comprehensive financial plan.

START PLANNING YOUR RETIREMENT TODAY!

Over the last ten years, Marshall Financial Transitions has transitioned more than ten financial advisor businesses to our firm, Marshall Financial Group. Our typical retention rate for clients is over 95%. This success is based on our robust and transparent transition process in which we work with you to align our goals and create an outcome where everyone – you, your clients, and Marshall Financial Group – comes out a winner.

We generally structure partnerships based on either the advisor’s preference, or what experience has proven to work best in a given scenario. Typical structures that we support include lump sums, Advisor Notes, and consulting payments. We typically work with advisors with over $50M in assets.

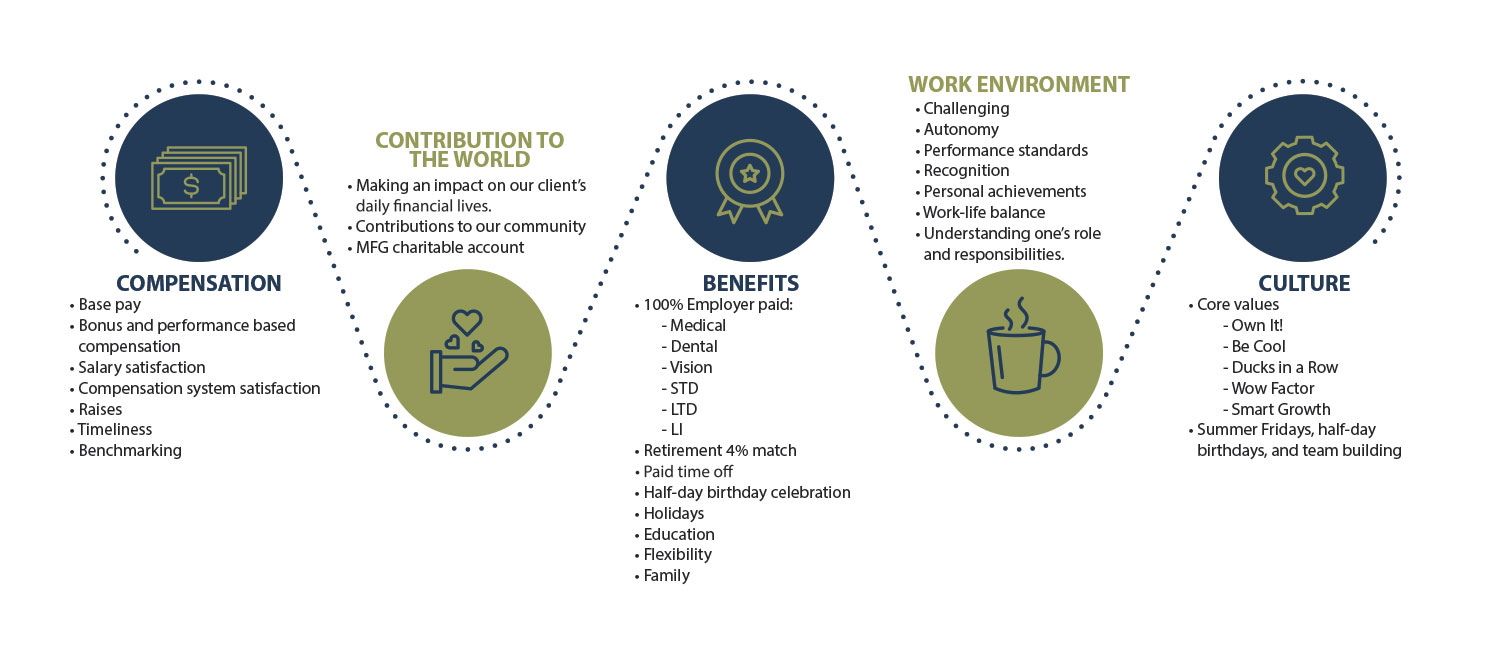

MFG is a wealth management firm that believes in smart growth for our clients as well as our team members. Our job is to help our clients grow their income and wealth – this is also the goal for our team members. We believe in a work hard, play hard mentality and strive to reward our team members for their commitment and loyalty. MFG offers best-in-class rewards and ensures that our employee compensation is above average.

UNLOCK THE VALUE OF YOUR FINANCIAL PRACTICE

Contact Marshall Financial Transitions to learn how.

The transition process is led by a team dedicated to onboarding your clients. Our transition team has extensive experience with transitions and knows how to create a smooth process for all parties. Needless to say, there’s a lot of paperwork involved with transitioning a practice, but our team knows how to handle it. We also work with a third-party firm and transition company that can assist with confidential information prior to a transition.

Clients appreciate our use of the latest reporting and trading software, our model portfolios, and a structured marketing schedule that includes many client retention initiatives. The Marshall Financial Group team strongly believes in providing consistent, exceptional client service. We take excellent care of our clients and make sure they know how much we value their business.

FAQS

Marshall Financial Transitions have developed a robust transition process as a result of our previous mergers. Our goal is to create alignment and clear transparency with the advisor’s joining us to create a winning result where the client wins, the advisor wins and we win. The transition process includes:

- A dedicated team for onboarding.

- Financial planning for new clients to begin forming a relationship.

- Investment analysis and potential new innovative strategies.

- Professional advice and ongoing support that is clear and responsive.

This depends on what the advisor prefers. Some advisors are looking for succession and leave very soon after the transition while some advisors are looking for a partnership for many years to come. We can and have accommodated both scenarios.

Our goal is to keep the same fee percentage as the clients have prior to the transition. Interestingly, this is usually the first question newly transitioned clients ask i.e. ‘Will my fees increase?’ Marshall Financial Group’s goal is to keep the same fee percentage, however, if they partake in additional services, we may have to increase our fees slightly. If this occurs, it will always be clearly communicated so there are no surprises. We try to avoid having multiple tiered fee schedules.

Marshall Financial Transitions has an internal team that manages the paperwork for our transitioning advisors. In addition, we also work with a third-party firm and transition company that can assist with confidential information prior to a transition.

The Marshall Financial Group advisors will work with you and your clients with the goal of having a successful match for each client. We will transition your clients to our advisors based on a number of differentiating factors that we will review with you to ensure it’s the right fit.

We have relationships with Charles Schwab, Fidelity, and Interactive Brokers. We also have some smaller custodial relationships.

Our goal is to transfer all assets ‘in kind’. After the clients are onboarded, we assess your clients’ risk tolerance and compare it to their current investment mix. Over time as we get to know the clients, the clients may or may not decide to change to one of the Marshall Financial Group investment strategies.

DO YOU HAVE QUESTIONS ABOUT HOW MARSHALL FINANCIAL TRANSITIONS CAN PARTNER WITH YOU?

Contact us – we are happy to answer your questions.

Yes, Marshall Financial Transitions has helped over 10 advisors in the last ten years transition to our Marshall Financial Group.

Marshall Financial Transitions and Marshall Financial Group are sister companies. Marshall Financial Transitions manages all mergers, integrations, and partnerships with established advisors. Marshall Financial Group is our RIA firm and the name that our clients know.

We are proud to share that our typical retention rate is over 95%.

The most common that we have seen include:

- Advisors have waited too long and now they are forced to rush this decision based on a personal or professional complication.

- Choosing an inexperienced advisor or firm that doesn’t know how to manage the transition process.

- Not communicating well and/or being transparent about their preferred post-transition role.

Yes, we believe strongly in financial planning, and it is the backbone of our recommendations.

In our experience, the process takes between 3 to 6 months to become organized for the pre-transition portion of the process. After the advisor joins Marshall Financial Group and the accounts begin to transfer, the client onboarding process takes about 6 months. In the first year, we have an increased touchpoint system to ensure their comfort with us. After the first year, we typically convert back to our regular client touchpoint system.

A merger/acquisition is a very exciting time and regardless of preparation, it can also be stressful. Our ideal candidate would be accountable, positive, organized, responsive, and most importantly care about their clients.