By: Sheryl Parks

The first quarter of 2025 was a notable period of transition. January brought a new year, new administration, changing economic data, and new policies, all of which contributed to an increase in market volatility during the quarter. Changes can cause investors to question their current investment allocation and potentially increase the debate over whether this provides an attractive buying opportunity or could potentially signal greater volatility ahead. We believe that market turbulence will continue in the near term but ultimately lead to higher overall potential for portfolio performance in the long term.

This year we have seen changes to trade policies including the use of tariffs. As history has shown, the United States can weather changes to trade policies, although higher tariffs can potentially impact economic activity and raise import prices. The U.S. has the advantages of size, economic resilience, and consumers with money to spend. Businesses have increased investments in the U.S., both domestically and abroad from companies eager to maintain access to the world’s largest economy. Investors are now focused on navigating the ambiguity caused by shifting trade policies and their future impact on businesses and consumer confidence. Disruptions to the market will continue as policy changes are implemented and negotiations continue with our trading partners all while the administration seeks to protect domestic economic interests.

The growth of Gross Domestic Product (GDP) is an important measure of economic activity and health of the economy. Although it appears that GDP is slowing there is still general sentiment among economists that GDP for 2025 will end positively. Earnings growth estimates remain positive with Q1 2025 estimated earnings growth rate for the S&P 500 at 7.3% as of March 28, 2025. This, however, falls below the estimate of 11.7% at the start of the quarter (12/31/2024).1 Together these indices indicate a slowing economy which could lead to more recessionary pressures.

We know from history that market and economic cycles are inevitable, despite the initial triggering events. With the recent volatility the P/E ratio for the S&P 500 has declined to territory that is more approachable from a buyer’s perspective than the 2024 year-end level. This lends credence to the increase in potential buying opportunities during this time.

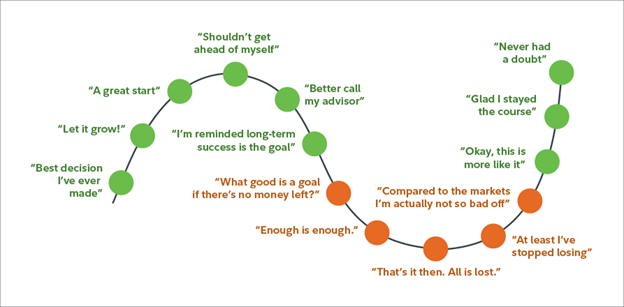

The following illustration depicts the thought and/or emotional stages that investors might experience during typical market cycles.

https://www.fidelity.ca/en/stayinvested/

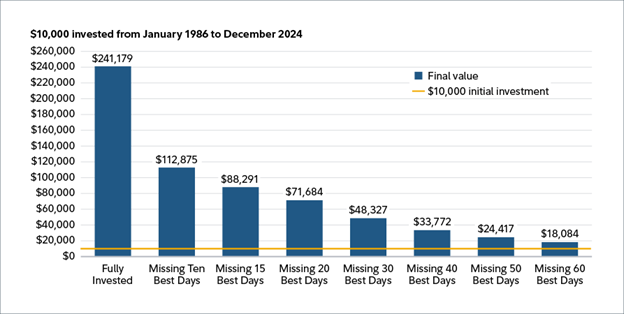

Considering the potential volatility anticipated in the near term, some investors might consider reducing losses by converting equities to cash (or other fixed investments). The challenge then becomes attempting to predict when the market will reach the lowest point to “time” reentry. Often these same investors are not confident regarding the best reentry point and therefore miss the earliest days of recovery which hold the greatest opportunity for gains. Consider the historical impact of missing the best days in the market. Source: Refinitiv. Index total returns from January 1,1986 to December 31, 2024. Past performance is no guarantee of future results. It isn’t possible to invest directly in an index.

Source: Refinitiv. Index total returns from January 1,1986 to December 31, 2024. Past performance is no guarantee of future results. It isn’t possible to invest directly in an index.

In light of recent economic data, in March the FOMC maintained the federal funds rate target range at 4.25% to 4.5%. In a statement following the meeting, the committee acknowledged that while inflation remains elevated, it has moderated over the past year. The Fed’s economic projections include the expectation of slower growth and higher core inflation by year-end. We anticipate that the Fed will continue to look for additional clarity on the economic impacts of the new policies by the Trump administration with general consensus that a gradual easing of interest rates could occur later this year.

The Investment Team at Marshall Financial Group continues to monitor and discuss all these market themes closely in our investment committee meetings. While it is inherently difficult to forecast near-term market direction, history has shown that long-term investment performance is greatest when portfolios remain invested in a well-diversified allocation during periods of market volatility.

Marshall Financial Group remains dedicated to the achievement of your long-term financial goals. We are here to discuss these developments and the implications for your portfolio. Please reach out if you have any questions or would like to schedule a meeting.

Thank you for the opportunity to continue to serve your financial needs.